Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment. Take 2 mins to learn more.

Ingenious Estate Planning Classic & Care Service 2025 Rights Issue

Please note that the availability of Business Relief from Inheritance Tax and Investors’ Relief for capital gains tax will be subject to the changes announced in the Autumn 2024 budget.

Important notice – offer now closed

The Ingenious Estate Planning Limited Rights Issue offer closed 5pm, Wednesday, 17 December 2025. The issue of the Rights Issue Shares is expected to take place by 15 January 2026, or earlier if practicably possible over the Christmas Period.

We’re offering existing shareholders in Ingenious Estate Planning Classic & Care (the “Services”) the opportunity to invest further through a “Rights Issue” – a chance to buy additional shares that may immediately qualify for Business Relief.

Why Invest

“The Rights Issue provides an opportunity for investors to commit additional capital to Ingenious Estate Planning Limited (the “Company” or “IEPL”) to support Ingenious’ established real estate lending strategy and at the same time enjoy immediate qualification for Business Relief (BR), if their current shares satisfy the 2-year holding period requirement.”

The Services are managed by Ingenious Capital Management Limited (“Ingenious”), which has a proven track record delivering high-quality secured development and bridge finance loans across established UK markets.

The Rights Issue has been designed to meet increased demand from borrowers for financing driven by reducing interest rates and the structural lack of supply across UK residential markets.

Over the past five years, the Company’s real estate lending strategy has delivered an average net return of 3.97% per annum, with no capital losses across all exited positions. Since inception in May 2014 the strategy has achieved a total growth rate of 62.9% net of charges. The Company’s disciplined approach (which focusses on first charge secured lending, institutional grade underwriting and market insight), has supported consistent performance across varying market conditions.

Additionally, new shares are issued to investors, which may lead to reduced Capital Gains Tax liabilities on withdrawals after three years, subject to individual circumstances.

Key highlights

Proposed Rights Issue to be issued by Ingenious Estate Planning Limited on a 3-for-1 basis.

Targeting larger-scale, institutional-grade real estate lending opportunities, including low-carbon developments.

Target return 3–5% per annum, net of fees.

New shares are expected to qualify for Business Relief (BR) immediately, assuming the original shares are eligible.

Rights Issue proceeds will be allocated solely to the secured real estate lending strategy.

Existing product fees and charges under the Services will continue to apply.

Participation must be supported by regulated financial advice.

New shares will be issued at the 30 June 2025 NAV.

Documents & Downloads

Risk Warning

Please note that we require investors to take financial advice before completing an application for Ingenious Estate Planning.

AcceptRisk Warning

Please note that we require investors to take financial advice before completing an application for Ingenious Estate Planning.

AcceptRisk Warning

Please note that we require investors to take financial advice before completing an application for Ingenious Estate Planning.

AcceptRisk Warning

Please note that we require investors to take financial advice before completing an application for Ingenious Estate Planning.

AcceptFAQs

What is a rights issue?

A rights issue is an invitation from a company to its existing shareholders to purchase additional shares in the company. This type of issue offers these shareholders securities called rights. In these rights offerings, companies grant shareholders the right, but not the obligation, to buy new shares within a defined window of time.

Why are the Ingenious Estate Planning Classic and Care Services undertaking a rights issue?

The Company is undertaking a rights issue to raise additional capital to undertake further real estate lending transactions. Currently, the Companyand its subsidiaries have a pipeline of potential lending opportunities which exceed available capital. Undertaking additional lending transactions is good for shareholders as returns should increase and a larger portfolio of loans reduces concentration risk.

How does a shareholder participate in the rights issue?

They complete the application form sent with the rights issue information, ask their IFA to complete the declaration on the application form and return the form and make payment as instructed in the application form.

Can the right to subscribe for new shares be sold?

No. As the company raising capital is not a listed company there is no market for the rights.

Why subscribe for additional shares?

The new shares obtained under the rights issue (“Rights Issue Shares”) will qualify for Business Relief (BR) immediately if the original shares have already been held for 2 years at the date of the rights issue and the company issuing the shares is a trading company or the holding company of a trading group.

Why may the new shares subscribed for in the rights issue qualify for business relief immediately when a new investment into IEP classic has a 2-year qualifying period?

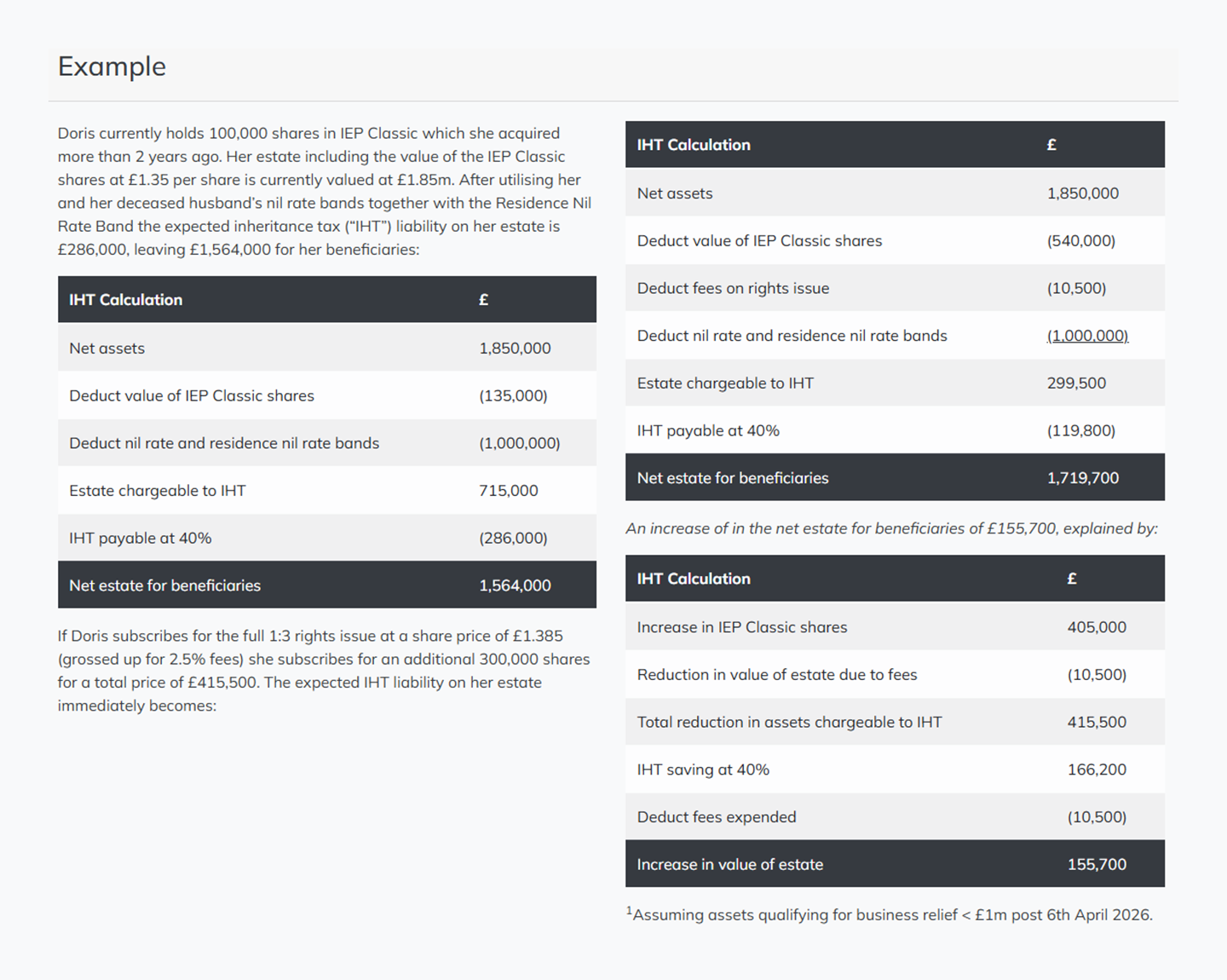

As the Rights Issue Shares acquired are derived from Doris’s original shareholding in the company in the example above, the Rights Issue Shares take on the ownership period of the original shares for BR purposes.

Is this an aggressive interpretation of the tax rules?

No. The Rights Issue, is a qualifying reorganisation for Capital Gains Tax purposes in accordance with s126 to s136 of TCGA 1992. As the Rights Issue Shares acquired are derived from the Qualifying Shareholder’s original shareholding in the Company, then the Rights Issue Shares should take on the ownership period of the original shares for Business Relief purposes per s107(4) IHTA 1984.

Have ingenious taken specific tax advice on the iht treatment of the rights issue shares?

Yes. Ingenious has an opinion from a leading tax KC that the issue of the Rights Issue Shares should qualify as a reorganisation of share capital within s126 – s136 TCGA 1992 and therefore take on the ownership period of the original shares per s107(4) IHTA 1984.

Does HMRC accept the above tax analysis?

Yes. HMRC’s published guidance manuals at SVM111090 confirm:

“A bonus or rights issue should not normally be regarded as a newly acquired holding for the purpose of the ownership tests. Provided the bonus or rights shares were issued in proportion to all the shares of a company – or to all the shares of a particular share class – the allotment to the transferor will come within s.107(4). Care needs to be taken with rights issues, however, and all cases involving them should be referred to the Litigation and Technical Advice Team (LTAT).”

Applications can only be made through an authorised financial adviser. We do not accept applications directly from retail investors. You should speak to your adviser to determine whether this investment is appropriate for your individual circumstances.

More information about the potential benefits and risks can be found in the Ingenious Estate Planning Limited Rights Issue Prospectus, IEP Classic Brochure, IEP Classic Investor Agreement and Rights Issue Application Form.

There is no guarantee that shares issued to you will be wholly or partly Business Relief or Investors’ Relief qualifying at the date of a future transfer of your shares. Tax rules could change in the future and the value of any tax relief will depend on your personal circumstances.

Important information

Past performance is not a guarantee of future returns. As with any investment, there are inherent risks involved in investing in any of our products and money invested may both increase or decrease in value and your capital is at risk. There is no guarantee that you will be repaid all of your invested capital.

No Ingenious Group company provides or is authorised to provide investment or tax advice.